What We Do

Golden Ark Reserve provides a structured operating model for physical gold ownership.

The company focuses on coordinating documented gold transactions, custody arrangements,

and settlement processes designed for legal clarity, control, and verifiable ownership.

Structured Gold Ownership

-

Structured Gold Ownership — physical gold is acquired under documented agreements

that define pricing terms, ownership allocation, custody instructions, and transferability.

Custody & Asset Protection

-

Custody & Asset Protection — holdings are maintained under insured custody

arrangements with defined segregation, access rules, and independent verification mechanisms.

Settlement Coordination

-

Settlement Coordination — transactions are settled through established banking

rails or approved digital asset settlement methods, aligned with documented settlement terms.

Ownership Continuity

-

Ownership Continuity — the same operational framework applies from acquisition

through custody and resale, ensuring consistency of records and legal title throughout the

holding period.

Regulated Operating Context

-

Regulated Operating Context — all activities are conducted within defined

regulatory and compliance frameworks supporting auditability and due diligence requirements.

This operating model is designed for clients seeking structured ownership and custody of

physical gold outside standard retail purchase formats.

How Gold Ownership Is Structured

Gold ownership through Golden Ark Reserve is structured as a documented ownership transaction. Each transaction follows a defined sequence covering pricing, settlement, allocation, custody instructions, and reporting. This structure establishes clear legal title, verifiable allocation, and operational continuity throughout the holding period.

Who Uses This Framework

This framework defines how physical gold is acquired, held, and managed when ownership clarity, documented allocation, and predictable settlement are required. It applies to gold held as an accountable asset — with verifiable title, insured custody, and structured resale pathways — rather than as a retail commodity. The model supports transparent ownership records, cross-border settlement, and audit-ready documentation throughout the full holding lifecycle.

Private investors

Family offices

Corporate treasuries

Investment mandates and managed structures

International buyers

Framework Application Scenarios

Governance, Verification & Risk Controls

This framework is governed by documented procedures that define operational roles, control points, and accountability across ownership, custody, and settlement. Governance is designed to ensure consistency of records, role separation, and predictable execution throughout the lifecycle of physical gold ownership.

Governance Structure

Operational governance is based on documented procedures that define roles, responsibilities,

and control points across ownership, custody, and settlement. Role separation is used to reduce

concentration risk and ensure accountability throughout the lifecycle of physical gold ownership.

Verification Layers

Ownership and custody are supported by multiple verification layers, including allocation records,

custody documentation, and independent inspection mechanisms where applicable. These layers enable

traceability, ownership confirmation, and third-party review without reliance on retail processes.

Risk Controls

Risk controls are embedded at each stage of the framework through defined custody rules, access

restrictions, insurance coverage, and documented operational procedures. These controls are designed

to mitigate operational, counterparty, and custody-related risks during the holding period.

Documentation Integrity

Transaction and custody records are maintained as a continuous documentation set from acquisition

through resale or transfer. Documentation integrity supports audit readiness, compliance review,

and consistent confirmation of ownership and custody status over time.

Operational Continuity

Governance mechanisms ensure that ownership, custody, and settlement remain aligned during resale,

transfer, or delivery. This continuity preserves legal title, allocation records, and custody

instructions without reclassification or disruption of the ownership framework.

Legal Entity Identification & Registrations

This section outlines the formal identifiers and institutional registry records under which the legal entity operates within global financial, compliance, and market data infrastructures. These identifiers enable consistent recognition of the entity across regulatory, banking, and institutional systems. These records reflect legal entity identification within global registries and data systems and do not constitute regulatory licenses or activity authorizations. View full compliance and registry records

Issued and maintained within the Global Legal Entity Identifier System under the oversight of the Global Legal Entity Identifier Foundation (GLEIF). The LEI provides a globally recognized and regulator-backed identifier for the legal entity.

A permanent institutional identifier issued within the Refinitiv data ecosystem operated by the London Stock Exchange Group (LSEG), enabling consistent identification of the legal entity across financial markets, compliance platforms, and institutional datasets.

Registered in the FactSet Entity Master database, enabling institutional identification across financial research, risk management, compliance, and capital markets platforms. FactSet entity records are used by banks, asset managers, and institutional counterparties for entity resolution and data normalization.

Listed in Bureau van Dijk’s Orbis global corporate database, providing standardized legal entity data used for due diligence, compliance screening, ownership analysis, and institutional research across banking and regulatory environments.

The identifiers and registry records listed above represent legal entity recognition within global institutional data systems. These records do not constitute regulatory licenses, financial authorizations, or supervisory approvals and are provided solely for entity identification, compliance referencing, and institutional data integration purposes.

Company Registration Documents

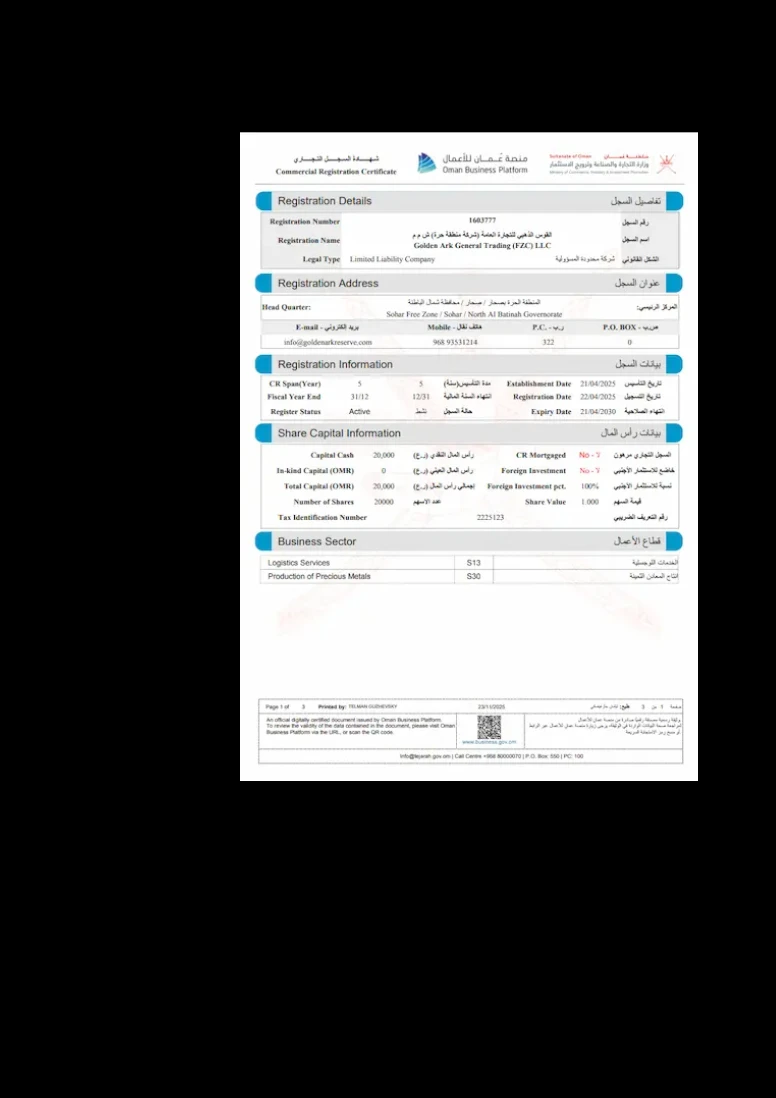

Legal Entity:

القوس الذهبي للتجارة العامة (شركة منطقة حرة)

(Golden Ark General Trading (FZC) LLC)

Registration No.: 1603777

Jurisdiction: Sohar Free Zone, Sultanate of Oman

Registered Activities:

Import & export of precious metals (Code: 461003)

Wholesale bullion and precious metals trading (Code: 469001)

Precious metals production and processing (Sector: S30)

Logistics services for bullion flows (Sector: S13)

Wikidata Entity Record:

https://www.wikidata.org/wiki/Q137885502