How the Offline Gold Purchase Process Works

All in-person gold purchases are conducted by appointment in our Hong Kong office at 7 Cannon Street. Each transaction follows an institutional procedure: identity verification, product confirmation, on-site authentication of the bullion, structured settlement, and optional storage or same-day collection. The minimum purchase volume is 1 kg.

Private Rooms for Face-to-Face Gold Transactions

All in-person gold purchases are conducted in dedicated private rooms within our Hong Kong office at 7 Cannon Street, Causeway Bay. Each transaction follows a controlled procedure that includes secure handover, on-site authentication, proper documentation, and supervised settlement.<br>This environment ensures confidentiality, eliminates retail exposure, and provides a structured setting for institutional bullion transactions.

Schedule a Private Appointment

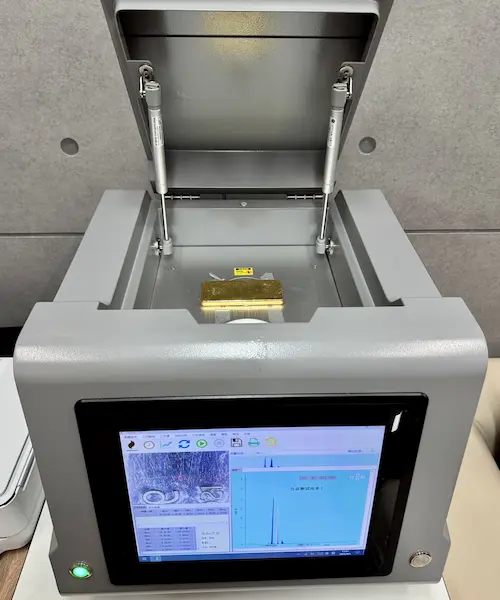

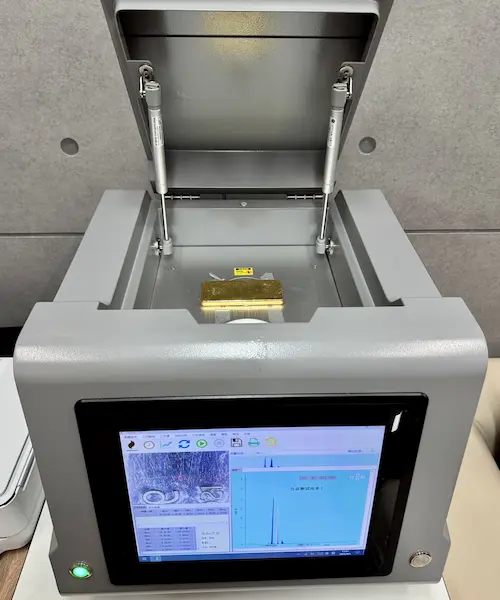

Bullion Verification and Purity Checks Before the Transaction

All in-person purchases include full verification of the bullion on site. Our Hong Kong office is equipped with professional-grade testing systems to confirm purity, weight, and structural integrity before settlement. The process is conducted under controlled conditions, ensuring the client receives authenticated gold that meets institutional standards.

A Secure, Transparent Framework for Offline Gold Purchases in Hong Kong

Every offline gold purchase at Golden Ark Reserve follows a controlled institutional process conducted in our Hong Kong office at 7 Cannon Street. Clients receive transparent pricing linked to the LBMA spot rate, authenticated bullion, formal settlement procedures, and options for insured custody or same-day collection. Minimum purchase volume: from 1 kg.

Post-Purchase Options: Storage, Insurance, Custody

After completing the offline purchase in our Hong Kong office, clients may either collect the bullion in person or place it into insured, numbered custody. All storage is conducted under institutional standards with independent audits, full documentation, and 24/7 access to verification records.

Offline Gold Purchase in Hong Kong: A Structured, Institutional Approach to In-Person Bullion Transactions

Purchasing gold offline in Hong Kong is a preferred method for clients who require a controlled environment, direct authentication, and formal settlement procedures. Golden Ark Reserve provides an appointment-only framework for in-person bullion acquisition, conducted in our office at 7 Cannon Street, Causeway Bay. Each transaction follows documented steps: pre-confirmation, verification, authentication, price execution, settlement, and post-purchase options such as insured custody or secure collection.

Hong Kong’s established bullion market, combined with 0% tax on investment-grade gold bars, enables an efficient structure for private investors, corporations, and family offices seeking a compliant and secure way to acquire physical gold.

What Offline Gold Purchase in Hong Kong Means

Offline bullion acquisition is a structured process conducted in person, where clients inspect and authenticate the bar before settlement. Unlike retail walk-ins or gold shops, institutional offline purchases require advance scheduling, compliance screening, and secure handling procedures. This model provides:

– direct verification of the gold bar

– transparent pricing linked to LBMA spot

– controlled settlement through bank channels or crypto

– secure collection or placement into custody

– clear documentation and audit trails

This format eliminates uncertainty and provides full operational clarity for high-value transactions.

Why Clients Choose Offline Gold Purchases in Hong Kong

Hong Kong remains a global center for precious metals due to its transparent regulations, stable financial environment, and zero-tax treatment of investment-grade bullion. Clients selecting the offline method benefit from:

Institutional security — transactions occur in controlled private rooms with strict handling protocols.

Authentication before settlement — the bar is inspected, verified, and documented.

Regulatory clarity — Hong Kong maintains a tax-efficient environment for bullion.

Proximity to Asian markets — convenient hub for investors operating across the region.

This model is suited for clients who prefer direct oversight and documented procedures rather than remote or online execution.

How the Offline Gold Purchase Process Works

1. Appointment & Pre-Confirmation

A scheduled appointment is arranged to confirm bar specifications, availability, and procedural steps.

2. Compliance Verification

Identity documentation is reviewed according to AML requirements before the transaction begins.

3. Private Transaction Room

Clients meet in our Hong Kong office, where the bar is presented, inspected, and authenticated.

4. Price Execution

The LBMA spot price is shown in real time, and the final executable price is confirmed.

5. Settlement

Payment is completed via bank transfer to our corporate account in Oman or through approved crypto assets. All settlement steps are documented.

6. Collection or Custody

Clients either collect the gold in person or place it into insured, individually allocated custody.

This framework ensures full transparency and operational structure for each step of the transaction.

Pricing, Authentication & Settlement Structure

Pricing is based on the LBMA spot rate, with predefined premiums communicated before the appointment. During the session, clients verify the gold bar, review the serial numbers, check documentation, and confirm the settlement terms.

Authentication includes:

serial number verification

origin documentation review

purity confirmation

visual and physical inspection

Settlement follows institutional procedures with formal confirmation before handover or storage.

Post-Purchase Options: Custody, Insurance, Documentation

After settlement, clients may place the bullion into secure custody in Hong Kong or other global locations. Custody features include:

individually allocated storage

independent audits (SGS / Alex Stewart)

all-risk insurance

serial-number barlists

24/7 access to documentation

This option is preferred by clients who require long-term protection, structured reporting, and institutional compliance.

Who Benefits from Offline Gold Purchases

This model is suited for:

private investors acquiring physical bullion

corporations executing structured asset transactions

family offices managing diversified portfolios

clients requiring in-person oversight and formal verification

buyers seeking to combine acquisition with custody

Transactions begin from 1 kg, ensuring alignment with institutional standards.

Why Choose Golden Ark Reserve for Offline Gold Purchases

Golden Ark Reserve provides a controlled, transparent, and audit-ready environment for offline bullion acquisition. Key advantages include:

appointment-only process in our Hong Kong office

documented authentication of each bar

structured settlement via bank or crypto

insured custody options with independent audits

compliant AML framework

0% tax environment for investment-grade gold

The result is a secure, predictable, and professionally managed process for clients operating at institutional scale.

Conclusion: A Clear and Secure Method for Acquiring Gold in Person

Offline gold purchase in Hong Kong offers full oversight, authentication, and structured settlement — essential for clients conducting high-value bullion transactions. Golden Ark Reserve provides a transparent, compliant, and institution-grade workflow that integrates inspection, pricing, settlement, and custody within a single framework.

This model ensures operational clarity and enables clients to acquire and hold physical gold with confidence and regulatory certainty.

Track the Gold Spot Price

Real-time reference rate for physical gold across global exchanges. Updated live, 24 hours a day.

View Full Chart