How the Buyback Process Works

The buyback procedure follows an institutional workflow with documented authentication, transparent pricing, and controlled settlement. Each step is executed under established bullion standards to ensure accuracy, traceability, and predictable liquidity for corporate and private sellers.

Get your custom gold custody proposal

Personalized custody terms, fees, and settlement options delivered directly

Request Proposal

Settlement Options

Settlement is executed through controlled, documented procedures aligned with institutional bullion standards. Clients may select bank transfer, corporate settlement, or crypto, with same-day release upon verification.

Compliance & Documentation

All gold buyback transactions at Golden Ark Reserve follow regulated compliance procedures. Each step is supported with formal documentation, identity verification, and traceable records aligned with institutional standards in both Hong Kong and Oman.

Accepted Gold Bars and Bullion Formats

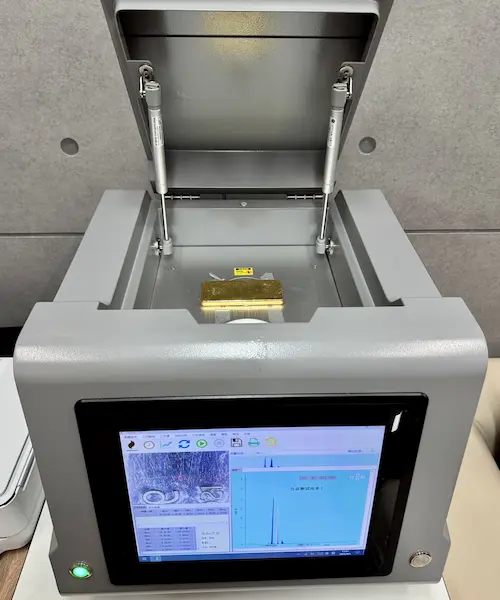

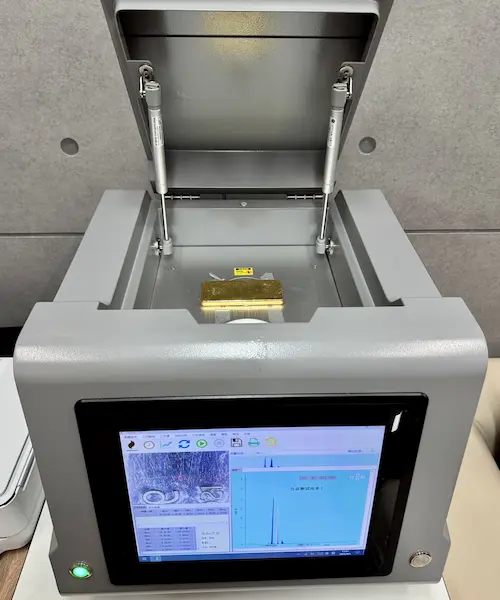

Golden Ark Reserve operates a defined buyback list for investment-grade bullion. Each format is authenticated, serialized, and priced against the live LBMA spot before settlement in Hong Kong.

400 oz LBMA Good Delivery Bars

Recognized global standard for institutional bullion trading. Fully serialized bars from approved refiners, accepted for high-volume liquidation and vault-to-vault settlement.

1 kg Investment Bars (999.9)

Kilobars produced by accredited manufacturers, suitable for corporate and private portfolios. Accepted for buyback when serial numbers, refiner marks, and purity are clearly verifiable.

100 g–500 g Investment Bars

Smaller denomination bars from approved refiners. Eligible for buyback when hallmarked, serialized, and accompanied by traceable fabrication records.

1 oz Bullion Bars

Investment-grade 1 oz bars with confirmed refiner identity and purity specifications. Accepted for buyback under the same authentication and pricing procedures as larger bars.

Pricing Model and Liquidation Rates

Gold buyback valuations follow a transparent pricing model anchored to the LBMA spot. Each transaction is documented, with premiums or discounts applied based on bar format, purity, and liquidity conditions. This framework ensures predictable liquidation for corporate and private sellers.

LBMA Spot as the Primary Price Reference

All valuations are benchmarked against the live LBMA spot price at the time of authentication. This ensures alignment with global trading standards and supports accurate settlement for institutional transactions.

Premium and Discount Structure

Kilobars produced by accredited manufacturers, suitable for corporate and private portfolios. Accepted for buyback when serial numbers, refiner marks, and purity are clearly verifiable.

Liquidity by Bar Format

400 oz and 1 kg bars maintain the highest liquidity due to institutional acceptance. Smaller denominations, including 100 g–500 g and 1 oz bars, are priced according to current bullion demand and verified refiner origin.

Documented Settlement Calculation

Sellers receive a clear settlement statement outlining spot reference, adjustments, final valuation, and payout terms. This documentation supports internal reporting and corporate compliance requirements.

Track the Gold Spot Price

Real-time reference rate for physical gold across global exchanges. Updated live, 24 hours a day.

View Full Chart

Frequently asked questions

LBMA Good Delivery 400 oz bars

1 kg bars with 999.9 or 995+ purity

Certified 100 g, 250 g, and 500 g bars

1 oz bullion coins and bars from recognized refiners

All bullion must contain a readable serial number, hallmark, and originate from an approved or internationally recognized refinery list.