Physical Specifications and Standards

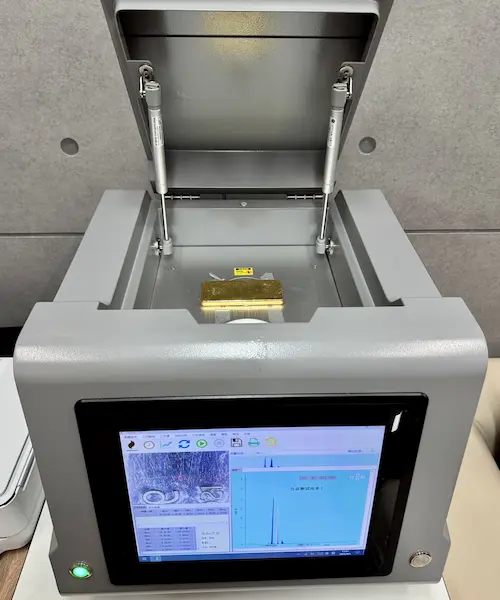

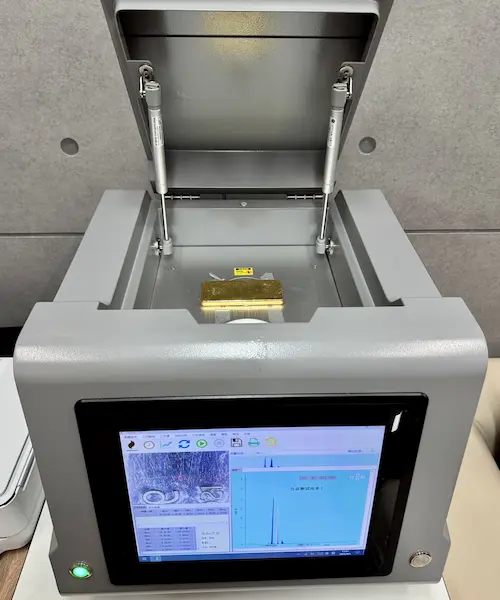

The 1 kg gold bar conforms to dimensional, weight, and fineness tolerances accepted by LBMA-approved vault operators.

Bars meeting these specifications are eligible for allocated and segregated custody without additional re-assay or re-fabrication requirements.

| Parameter | Specification |

|---|---|

| Nominal weight | 1 kilogram |

| Fineness | 999.9 (99.99% gold) |

| Gold content | Investment-grade physical gold |

| Manufacturing standard | LBMA-accredited refinery |

| Form | Cast or minted bar accepted by LBMA-approved vaults |

| Identification | Unique bar serial number |

| Surface markings | Weight, fineness, refinery mark, serial number |

| Acceptance | Eligible for institutional vault custody |

Physical acceptance is governed by vault operator intake procedures and standard inspection protocols.

Bars that meet the stated specifications qualify for institutional storage, reporting, and audit frameworks.

Product Definition

A 1 kg gold bar is a standardized physical gold bar with a nominal weight of one kilogram and a purity consistent with LBMA Good Delivery standards.

The bar represents deliverable investment-grade gold accepted by institutional vault operators and eligible for professional custody arrangements.

The 1 kg gold bar is sold by Golden Ark Reserve as a physical commodity transaction.

The sale covers the transfer of ownership title in a specific, identifiable gold bar rather than a claim, pool interest, or synthetic exposure.

The product is designed for professional and institutional buyers who require direct ownership of physical gold combined with post-sale placement into allocated and segregated custody.

The bar does not function as a financial instrument, deposit substitute, or investment contract and remains a tangible asset held outside the balance sheet of the seller.

Transaction and Settlement Model

Purchase of a 1 kg gold bar follows a structured transaction process coordinated by Golden Ark Reserve. The model defines how pricing is confirmed, how settlement is executed, and when ownership of the physical bar is transferred.

Transaction Execution

- Price is confirmed against an institutional spot reference at the time of execution

- A specific physical bar is assigned upon transaction confirmation

- The transaction is executed as a direct sale of physical gold

Settlement Options

- Bank wire transfer via SWIFT in accepted fiat currencies

- Digital asset settlement with conversion into physical gold

- Combined settlement structures using fiat and digital assets

- Settlement is executed on a delivery-versus-payment basis

Ownership Transfer

- Ownership transfers upon confirmed settlement

- Title is assigned at the individual bar level

- Each bar is linked to a unique serial number

Transaction Completion

- Settlement is confirmed

- Ownership title is transferred

- The bar is accepted for placement into allocated and segregated custody

Post-Sale Custody Placement (Allocated and Segregated)

After completion of the transaction, the purchased 1 kg gold bar is placed into allocated and segregated custody with an independent third-party vault operator. Custody placement defines how the bar is held, recorded, and protected after ownership transfer.

Storage Locations and Jurisdictions

Physical storage of 1 kg gold bars is provided through institutional vault facilities operated by independent custody partners. Available vault locations, applicable jurisdictions, and cross-border holding considerations are documented separately.

View detailed information:

Gold Storage Vaults and Jurisdictions

View detailed information on gold storage vaults and jurisdictions

Risk and Responsibility Allocation

Risk allocation defines how responsibilities are distributed across the transaction lifecycle, custody phase, and post-sale holding of the 1 kg gold bar. Each party operates within a clearly defined operational boundary.

Integration Within Golden Ark Reserve Framework

The 1 kg gold bar is integrated into the broader physical gold acquisition and custody infrastructure operated by Golden Ark Reserve. The product functions as a standardized entry point within an end-to-end framework covering purchase, custody, reporting, and optional post-sale actions.

Framework Integration

- Purchase execution aligns with the physical gold buying workflow

- Custody placement follows the allocated and segregated gold storage model

- Reporting and audit mechanisms correspond to institutional custody standards

Related Infrastructure

- Gold custody documentation and legal structure

- Vault storage and custody reporting frameworks

- Physical delivery and capital transfer pathways

- Buyback and resale processes for physical gold holdings

Integration Boundary

- The 1 kg gold bar page defines the product and transaction scope only

- Detailed custody, storage, compliance, and delivery rules are documented on dedicated pages

- The product remains interoperable with other physical gold services within the platform