Why Institutions Acquire Physical Gold

Institutions acquire physical gold to establish direct ownership of a globally recognized asset, held outside the financial system and supported by documented allocation and independent verification.

Physical gold remains one of the most reliable assets for long-term capital preservation, offering universal acceptance, stable demand, and direct ownership without counterparty risk. Access to physical gold is typically structured through documented ownership and custody frameworks, ensuring legal clarity and verifiable allocation. Golden Ark Reserve provides access to certified bars and coins with secure storage and transparent pricing.

Get your custom gold custody proposal

Personalized custody terms, fees, and settlement options delivered directly

Request Proposal

How to Buy and Store Physical Gold — Step by Step

The physical gold purchase process follows a structured sequence designed for institutional transactions, ensuring price transparency, documented ownership, and verifiable custody at every stage. A structured acquisition workflow designed to keep ownership, pricing, settlement, and custody transparent. Each step is executed under documented terms, with verifiable allocation and clear custody instructions for storage or delivery.

What the Buyer Receives

- Physical gold bars with documented ownership

- Transfer of possession, delivery, or insured custody based on buyer instructions

- Transaction documentation and settlement records

- Optional independent verification and reporting

- Defined resale or delivery pathways

Types of Gold Available for Purchase

Golden Ark Reserve provides access to standard gold bar formats commonly used in regulated bullion transactions. All formats are handled under documented purchase, custody, and settlement arrangements, ensuring clarity of ownership, verifiable allocation, and consistency across storage and resale processes.<br><br>When custody is selected, gold is held on an allocated basis, identified by bar number and subject to independent verification.

Institutional Exit and Liquidity Options via Hong Kong Settlement

Hong Kong settlement structures are used to facilitate resale, liquidity, and capital movement for institutional gold holdings under established legal and tax frameworks. Exit transactions are executed under defined contractual terms, referenced to prevailing market prices, and aligned with applicable tax and settlement frameworks in Hong Kong.

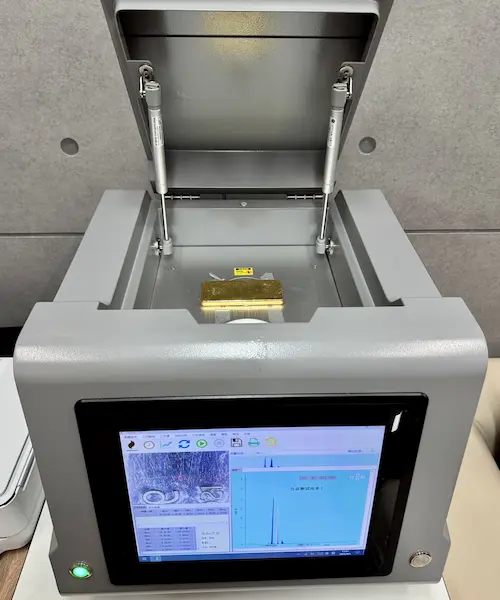

Independent Audits & Full Verification of Gold Bars

Every bar is individually numbered, insured, and verified by global auditors (SGS / Alex Stewart). Clients receive barlists, serial numbers, and certificates with 24/7 online access.

Buy Physical Gold Bars — Documented Ownership & Flexible Settlement

Purchasing physical gold through Golden Ark Reserve is structured as a documented ownership transaction, rather than a retail checkout.

This page describes the institutional framework for acquiring physical gold. Specific bar formats, weights, and custody configurations are detailed below.

Each acquisition is executed under formal agreements covering pricing, settlement, custody, insurance, and resale, ensuring clarity of title and verifiable allocation from the outset.

How Gold Ownership Is Structured

Gold ownership is established through a structured framework designed to ensure clarity, control, and transferability throughout the entire holding period.

- Pricing Transparency — spot-based pricing fixed at confirmation.

- Settlement Execution — transactions settled via bank transfer or approved digital asset settlement.

- Allocation Confirmation — ownership allocation initiated upon settlement confirmation.

- Custody Instructions — storage or delivery governed by documented custody terms.

Custody, Security & Independent Verification

Once acquired, gold is managed under secure custody arrangements designed to protect ownership and maintain independent oversight.

- Insured Vault Storage — all-risk insurance applies while gold is held in custody.

- Independent Verification — third-party inspections and audit controls support physical verification.

- Access & Withdrawal Rules — governed by documented custody agreements.

- Ongoing Reporting — ownership and custody documentation available upon request.

Settlement & Transaction Execution

All transactions are executed under predefined settlement terms to ensure predictable and compliant processing.

- Bank Transfer Settlement — executed via established international payment rails.

- Digital Asset Settlement — supported for approved cryptocurrencies where applicable.

- Market-Referenced Pricing — aligned with prevailing global gold prices.

- Post-Settlement Allocation — custody and reporting processes initiated after settlement confirmation.

Liquidity & Resale Framework

Gold holdings remain transferable within the same documented framework, supporting orderly resale and liquidity planning.

- Market-Based Resale — resale referenced to prevailing global spot prices.

- Structured Settlement — executed through established settlement channels.

- Documentation Continuity — consistent records maintained from purchase through exit.

- Tax-Efficient Structuring — resale structured in Hong Kong subject to applicable regulations.

Why This Structure Matters

This ownership framework is designed for clients who value control, transparency, and long-term capital preservation without speculative risk.

- Verifiable Physical Ownership — no pooled or paper exposure.

- Clear Operational Boundaries — separation of purchase, custody, and settlement roles.

- Global Market Acceptance — compatible with recognized bullion standards.

- Scalable Participation — consistent framework across different gold formats.

Request a Gold Ownership Proposal

Contact Golden Ark Reserve to receive a tailored proposal outlining transaction structure, settlement options, custody terms, and documentation requirements.

Track the Gold Spot Price

Real-time reference rate for physical gold across global exchanges. Updated live, 24 hours a day.

View Full Chart

The latest Golden Ark Reserve news

Buying Physical Gold: Market Integrity, Settlement, and Risk Control

Buying physical gold is a transaction process in which price agreement, delivery, ownership recognition, and settlement finality resolve…

How to Buy Physical Gold Offline in Hong Kong: Dealers, Process, and Transaction Security

Offline physical gold purchase in Hong Kong is a dealer-executed transaction where gold ownership transfers at the point…

Gold Spot Price vs Premiums: Structural Pricing Mechanics of Physical Gold

Gold spot price functions as a wholesale benchmark derived from financial gold markets. Physical gold trades through a…

CIF vs FOB for Gold Doré: Incoterms Allocation of Cost, Risk, and Delivery Obligations

Gold doré transactions use Incoterms to formalize delivery obligations, risk transfer, and cost allocation between seller and buyer.…

Gold vs Crypto vs Bank Transfers: How Capital Moves, Settles, and Stays Under Control

Capital can be transferred through three fundamentally different systems: bank rails, blockchain networks, and physical gold settlement. Each…

What Is the Gold Spot Price

Gold Spot Price is the globally recognized reference price for immediate gold transactions in the professional bullion market.…

Offline Gold Purchase: Benefits, Security Controls, and a Step-by-Step Process

Offline gold purchase is a transaction process in which a buyer acquires physical gold bullion through an in-person…

Why Invest in Physical Gold as a Long-Term Asset

Physical gold functions as a monetary asset with no issuer risk and no dependency on financial intermediaries. Investors…

How to Buy Gold with Bitcoin: Process, Settlement, and Custody

Buying gold with Bitcoin combines digital asset settlement with physical bullion ownership. This article explains how a Bitcoin-based…