Gold Bars as an Investment Asset

Gold bars are classified as an investment asset due to their standardised specifications, defined purity, and eligibility for wholesale bullion markets. Unlike decorative or retail products, bullion bars are produced under strict technical standards that allow them to be stored, audited, transferred, and resold within professional market infrastructure.

An investment-grade gold bar is defined by recognised weight formats, refinery identification, and documented specifications, rather than by branding or presentation. These characteristics ensure compatibility with institutional custody, independent verification, and global settlement frameworks.

Within professional bullion markets, gold bars function as fungible units of value, making them suitable for large-scale ownership, treasury allocation, and long-term capital positioning.

Gold Bar Sizes, Weights and Market Standards

Gold bars are produced in standardized weight formats that define their use in wholesale bullion markets, custody eligibility, and settlement infrastructure. Each format serves a specific role within professional gold trading and ownership.

400 oz Gold Bars (LBMA Good Delivery)

The primary format used in institutional and interbank bullion markets. Standardized for vault-to-vault settlement, large-volume liquidity, and professional custody worldwide.

1 kg Gold Bars

A widely recognized format for private, corporate, and structured holdings. Compatible with professional custody and secondary market resale when produced by accredited refiners.

100 g – 500 g Gold Bars

Mid-range bullion formats used for flexible allocation and structured ownership. Accepted within professional frameworks when refinery marks, serial numbers, and purity specifications are verifiable.

1 oz Gold Bars

Standardized small-denomination bullion bars produced by approved refiners. Used primarily for allocation flexibility and smaller-scale holdings within recognized bullion standards.

Technical Specifications of Gold Bars

Gold bars are defined by measurable technical specifications that determine their eligibility for professional custody, audit, and secondary market acceptance. These specifications are independent of branding and focus solely on physical and documentary attributes.

Purity Standards

Bullion gold bars are defined by minimum purity thresholds that determine their eligibility for wholesale markets and professional custody. The most widely recognized purity standards are:

- 995+ fine gold — the minimum requirement for LBMA Good Delivery bars

- 999.9 fine gold — commonly used for kilobars and smaller bullion formats

- Permanently stamped purity marks applied at the refinery level

- Independent assay confirmation as part of professional custody procedures

Purity classification ensures that gold bars remain interchangeable and acceptable across global bullion infrastructure.

Weight Tolerances & Dimensions

Gold bars are manufactured within defined weight tolerances specific to each standard format. These tolerances are established to maintain consistency across custody, audit, and settlement systems.

- Standard gross weight ranges defined by format and refinery

- Dimensional consistency required for vault handling and stacking

- Production tolerances aligned with LBMA and refinery standards

- Bars outside tolerance require re-assay or reclassification

Controlled weight and dimensional parameters ensure operational compatibility throughout the bullion market.

Refinery Identification & Hallmarks

Each bullion gold bar carries permanent refinery identification that links it to accredited production and certification records. These markings establish authenticity and market acceptance.

- Accredited refiner name or hallmark

- Official purity stamp applied during production

- Year of manufacture where applicable

- Compliance with LBMA or equivalent refinery standards

Refinery identification connects each bar to verifiable production and assay documentation.

Serial Numbers & Traceability

Individual serial numbers provide full traceability for bullion gold bars throughout their lifecycle. Serialization is a core requirement for allocated ownership and auditability.

- Unique serial number assigned to each bar

- Linkage to refinery certificates and assay reports

- Inclusion in custody barlists and ownership records

- Support for independent audits and resale verification

Traceability ensures transparent ownership and uninterrupted custody history.

Cast Bullion Production

Investment-grade gold bars are produced using cast bullion methods, designed for wholesale handling and long-term storage. This production process distinguishes bullion bars from retail-minted products.

- Molten gold poured into molds and allowed to solidify

- Surface stamped with weight, purity, refinery mark, and serial number

- Optimized shape and density for vault storage

- Compatibility with professional custody and audit systems

Cast production is the standard method for bullion bars used in institutional and wholesale markets.

Acquisition Models for Gold Bars

Gold bars are acquired through defined commercial and settlement models, depending on transaction scale, ownership structure, and payment method. Each model determines how bullion is purchased, allocated, and documented within professional market infrastructure.

Storage, Custody & Ownership Structure

Gold bars are held under a defined custody and ownership framework that governs how bullion is owned, stored, documented, and protected. This structure ensures that physical gold ownership is legally attributable, auditable, and compatible with professional bullion market standards.

Get your custom gold custody proposal

Personalized custody terms, fees, and settlement options delivered directly

Request Proposal

Gold Bar Formats Available for Purchase

Gold bullion bars are offered in standardized formats defined by weight, purity, and market use — from institutional settlement bars to flexible private holdings.

Individually serialized and refinery-marked

Eligible for professional custody and insurance

Balanced liquidity for acquisition and resale

How to Buy and Store Physical Gold — Step by Step

A simple and transparent process for purchasing gold bars and coins, with the option to store them in secure vaults or arrange delivery.

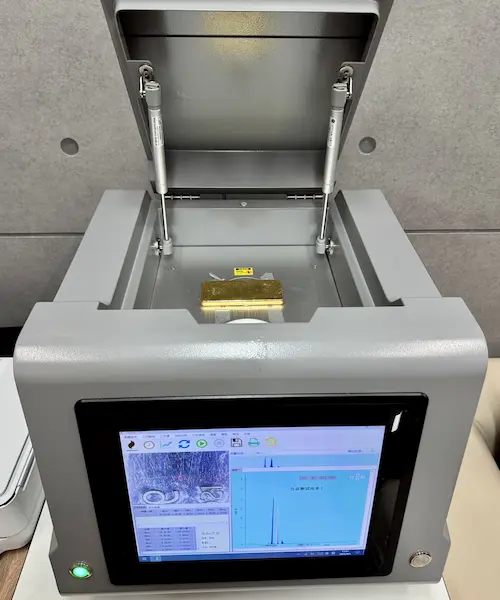

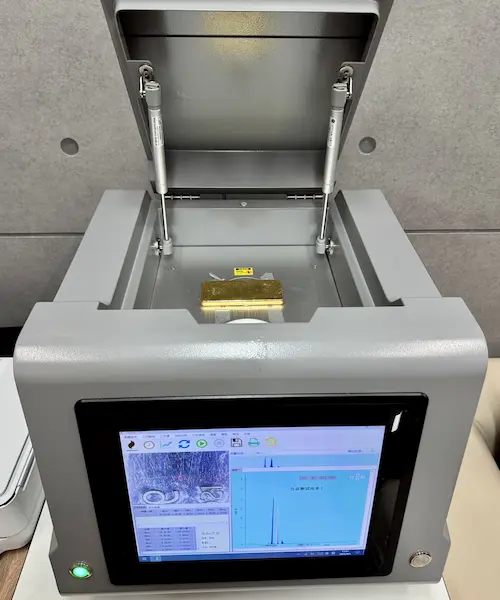

Independent Audits & Verification of Gold Bars

Gold bars held under professional custody are subject to independent verification and audit procedures that confirm physical existence, specifications, and ownership records. Verification is performed separately from custody operations to ensure objectivity and transparency.

Track the Gold Spot Price

Real-time reference rate for physical gold across global exchanges. Updated live, 24 hours a day.

View Full Chart

Frequently asked questions

The most commonly used formats include 400 oz LBMA Good Delivery bars, 1 kg kilobars, and selected medium-weight bars such as 100 g, 250 g, and 500 g, subject to availability.

Each format serves a different commercial and custody purpose. Institutional buyers typically operate with 400 oz bars, while private and corporate allocations often use 1 kg formats due to flexibility and liquidity.