Gold investment with 0% capital gains tax

Purchase 400 oz LBMA Good Delivery bars under investment contracts with secure custody and tax-free profit realization in Hong Kong.

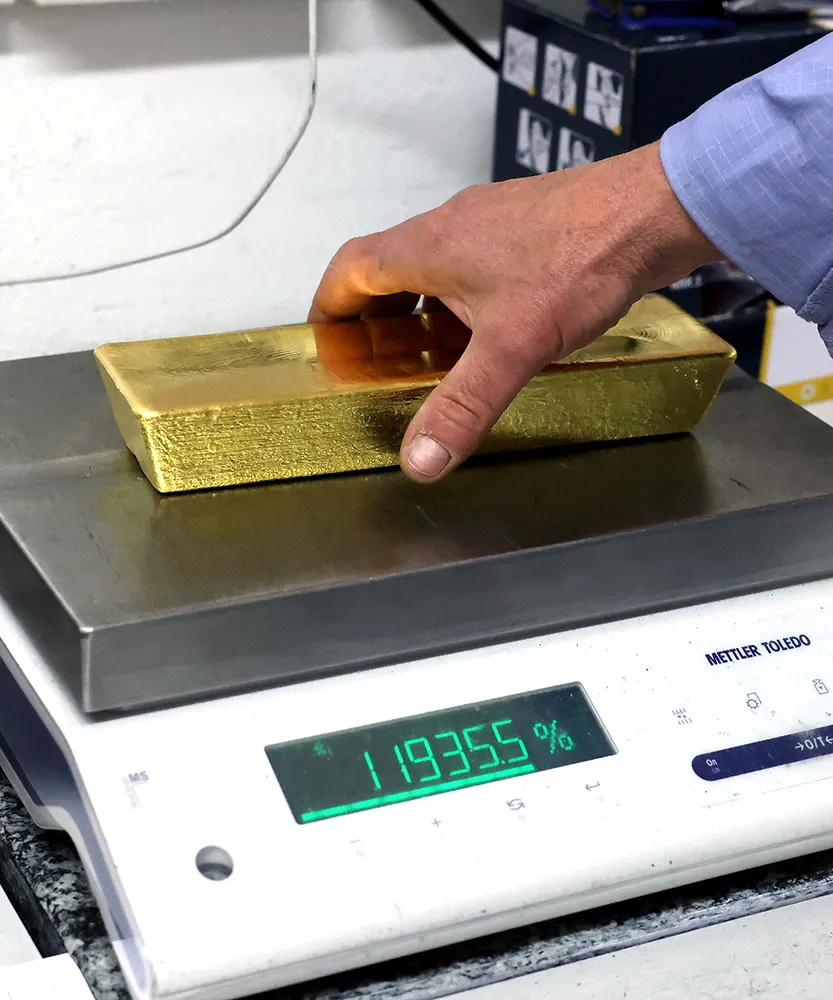

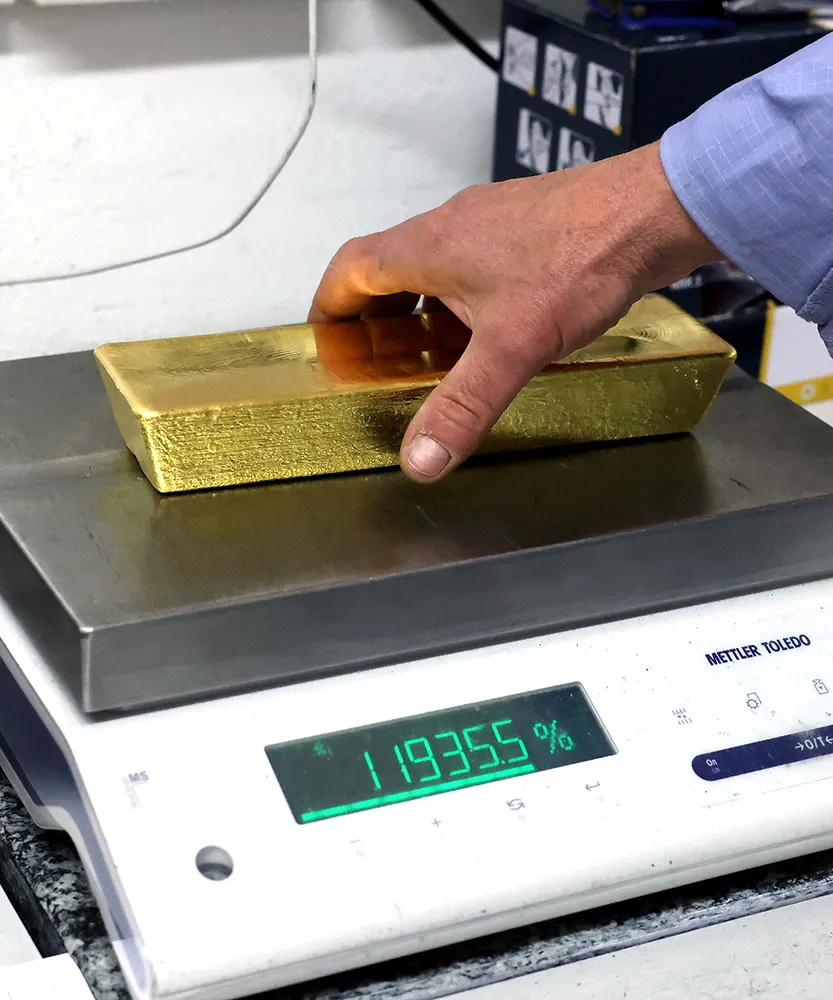

What You Own — Allocated Institutional Gold

Each investment account represents direct ownership of LBMA 400 oz (12.44 kg) Good Delivery gold bars held under allocated and insured custody. Your position is fully serialized, independently audited, and recorded within the vault reporting system. Ownership is established through a regulated investment contract, ensuring transparency, legal protection, and tax-free profit realization in Hong Kong.

Get your custom gold custody proposal

Personalized custody terms, fees, and settlement options delivered directly

Request Proposal

Exit & Liquidity — Global Settlement Without Tax Exposure

Institutional gold investments with Golden Ark Reserve remain fully liquid. Each LBMA 400 oz bar can be resold, transferred, or delivered through regulated settlement channels in Hong Kong and Dubai. All operations are executed at LBMA spot price with 0% capital gains tax, ensuring immediate access to capital while maintaining full compliance.

Track the Gold Spot Price & Calculate Your Investment

Real-time LBMA reference rate for physical gold. Use the calculator to price LBMA 400 oz bars or custom allocations, estimate custody costs and projected resale value under Hong Kong settlement (0% capital gains tax).

View Live Price & Calculator

Custody, Audits & Institutional Reporting

Each investment account includes full documentation and reporting on every LBMA 400 oz bar. All holdings are insured, serialized, and independently audited by SGS and Alex Stewart, ensuring verifiable proof of ownership for each investor. Clients receive 24/7 access to vault reports, insurance certificates, and barlists through a secure dashboard.

Invest in Gold Through Regulated Institutional Custody

Gold has remained the most trusted store of value for financial institutions, funds, and family offices. It offers stability against inflation, liquidity across global markets, and recognition in every major financial hub. Through Golden Ark Reserve, institutional investors gain direct exposure to LBMA 400 oz gold bars — the same standard used by central banks and bullion refiners.

Tax-Efficient Structure in Hong Kong

All investments are structured under a Hong Kong framework with 0% capital gains tax.

Profits from resale or transfer of gold are exempt from taxation, making Hong Kong the preferred jurisdiction for long-term asset preservation and global settlement.

Physical Ownership, Not Derivatives

Each position corresponds to individually numbered LBMA Good Delivery bars held under allocated custody.

Investors retain direct legal ownership — no pooled accounts, ETFs, or paper substitutes.

All holdings are audited and insured by international underwriters.

Custody and Reporting

Vaults in Dubai and Hong Kong operate under LBMA standards, providing barlists, audit certificates, and 24/7 account access.

Every transaction is verified by independent inspection agencies such as SGS and Alex Stewart.

Investment Accounts for Corporates and HNWIs

Institutional gold investment accounts are available for corporations, funds, and family offices.

Each account includes contractual ownership, audit rights, global delivery options, and insured custody — all within a single, compliant structure.

Exit and Liquidity

Positions can be resold at LBMA spot price in Hong Kong with zero profit tax or delivered physically through the global logistics network covering 50+ jurisdictions.

Summary

Investing in gold through Golden Ark Reserve combines the security of physical ownership with the efficiency of a regulated investment platform.

Each allocation is transparent, insured, and globally recognized — a structured path to long-term capital protection.

The latest Golden Ark Reserve news

When to Sell Gold: A Decision Framework for Timing Physical Gold Exits

Gold sale timing decision defines the conditions under which physical gold converts into liquidity within a defined market…

Buying Physical Gold: Market Integrity, Settlement, and Risk Control

Buying physical gold is a transaction process in which price agreement, delivery, ownership recognition, and settlement finality resolve…

How to Buy Physical Gold Offline in Hong Kong: Dealers, Process, and Transaction Security

Offline physical gold purchase in Hong Kong is a dealer-executed transaction where gold ownership transfers at the point…

Gold Spot Price vs Premiums: Structural Pricing Mechanics of Physical Gold

Gold spot price functions as a wholesale benchmark derived from financial gold markets. Physical gold trades through a…

CIF vs FOB for Gold Doré: Incoterms Allocation of Cost, Risk, and Delivery Obligations

Gold doré transactions use Incoterms to formalize delivery obligations, risk transfer, and cost allocation between seller and buyer.…

Gold vs Crypto vs Bank Transfers: How Capital Moves, Settles, and Stays Under Control

Capital can be transferred through three fundamentally different systems: bank rails, blockchain networks, and physical gold settlement. Each…

What Is the Gold Spot Price

Gold Spot Price is the globally recognized reference price for immediate gold transactions in the professional bullion market.…

Offline Gold Purchase: Benefits, Security Controls, and a Step-by-Step Process

Offline gold purchase is a transaction process in which a buyer acquires physical gold bullion through an in-person…

Why Invest in Physical Gold as a Long-Term Asset

Physical gold functions as a monetary asset with no issuer risk and no dependency on financial intermediaries. Investors…

Frequently asked questions

Each position is fully allocated, insured, and recorded in audited barlists held in LBMA-compliant vaults in Dubai and Hong Kong.