Spot vs Futures Gold: Key Differences for Institutional Investors

Gold operates within two interconnected valuation systems — the spot market, where ownership and settlement occur instantly, and…

Gold operates within two interconnected valuation systems — the spot market, where ownership and settlement occur instantly, and…

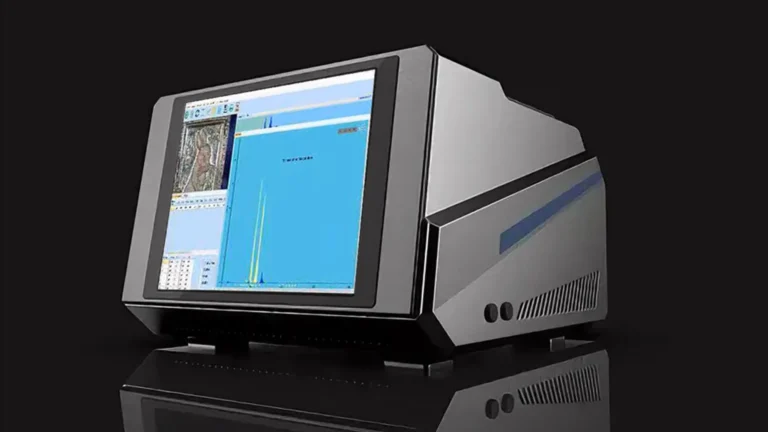

Gold verification relies on measurable, repeatable testing methods. Each method confirms the metal’s authenticity, fineness, and composition. Professional…

The gold spot price represents the live value of gold traded between global institutions — the benchmark from…

The 400-ounce London Good Delivery bar defines how institutions move, value, and protect physical gold. Its standardization under…

Institutional gold transactions are never casual purchases — they are executed through structured agreements that define every stage…

Institutions exploring gold today face two distinct models: tokenized gold, where digital tokens represent fractional ownership of bullion,…