Why Doré Transactions Require an Assay-Based Purchase Model

Gold doré is a semi-refined material with purity ranging from 60% to 95%. Accurate valuation is possible only after melting and fire-assay verification. The purchase process is executed under a formal agreement with secure handling, independent assay, and settlement based on net gold content in Hong Kong.

What Gold Doré Is

Gold doré is a semi-refined alloy produced from mined material or recycled gold, typically containing 60–95% gold with varying levels of silver and base-metal impurities. Doré requires melting and independent fire-assay verification to determine its actual purity and value. It is not an investment bar but a raw material that must be refined before institutional trading or settlement.

Request Proposal

A Single Transparent Framework for Doré Purchase & Settlement

Each doré transaction with Golden Ark Reserve follows a structured operational framework: secure intake, melting, independent assay, valuation, and settlement in Hong Kong. All steps are documented, insured, and executed under a formal purchase agreement for clarity, compliance, and predictable execution.

Doré Pricing

Doré is evaluated strictly by net gold content after melting and independent fire-assay verification. We purchase material with 60–90% gold purity, with commercial terms adjusted according to batch volume and purity characteristics. Final conditions are discussed individually after laboratory results. Minimum accepted lot: 5 kg.

Additional Notes:

– Melting removes inconsistencies in composition and allows accurate sampling.

– Final purity is determined by an accredited fire-assay laboratory.

– Discount reflects operational costs, impurity levels, and recovery factors.

What We Purchase

Clear acceptance criteria for doré transactions: purity range, format requirements, and minimum lot size for processing and settlement in Hong Kong.

Settlement Options

Payout is issued immediately after final fire-assay verification. Settlement is executed in Hong Kong under a structured purchase agreement with full compliance and documentation.

Full remittance confirmation provided.

Released immediately after assay with full transaction records and reference numbers.

Subject to pre-cleared compliance.

purchase agreement

melt & sampling report

fire-assay certificate

settlement confirmation

compliance record

Why Hong Kong Is the Preferred Settlement Hub

Hong Kong provides a stable, efficient, and tax-free environment for doré settlement. Transactions are executed under predictable legal standards with full banking access, institutional liquidity, and 0% profit tax on payouts. This makes Hong Kong one of the most reliable and capital-efficient gold settlement hubs worldwide.

On-Site Processing & Immediate Settlement in Hong Kong

Our doré operations are fully handled at our Hong Kong office. Sellers attend melting, sampling, and assay steps in person, with immediate settlement after the final report.

- Controlled on-site melting with the seller present

- Independent sampling and fire-assay performed immediately

- Documented chain of custody from intake to payout

- Immediate settlement via crypto or bank transfer

- All procedures executed inside our facility for full transparency

Hong Kong

Golden Ark General Trading FZC

7 Cannon Street

Causeway Bay

Hong Kong

+852 6413 7750

hk@goldenarkreserve.com info@goldenarkreserve.com

Process Timeline — Supervised Execution in Hong Kong

All core steps of the doré transaction are carried out under controlled supervision: intake, secure transfer to an accredited refinery, melting, sampling, and independent fire-assay verification.

Settlement is issued after the official assay report is released.

In high-volume periods or for larger batches, processing may require 1–2 business days depending on refinery load and laboratory queue.

We recommend booking your visit in advance to ensure priority execution.

Track the Gold Spot Price

Real-time reference rate for physical gold across global exchanges. Updated live, 24 hours a day.

View Full Chart

Gold Doré: Origin, Composition, Assay Accuracy and International Selling Standards

Gold doré is a transitional material produced at mines, small aggregators, and recycled-metal facilities before final refining. Its composition varies by region, extraction method, and melting technique, making each batch unique. Doré from West Africa, East Africa, Central Asia and South America often contains visible inconsistencies in structure, silver ratio, slag, and base-metal residues. These variations directly influence purity and require controlled re-melting to achieve an accurate profile for fire-assay sampling.

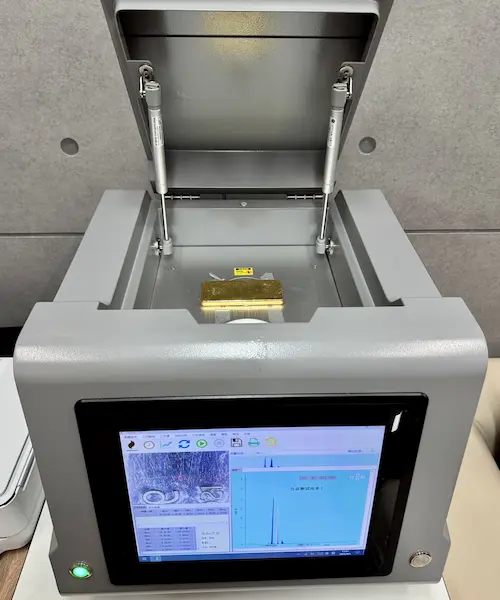

Fire assay remains the global reference method for establishing true gold content. Handheld XRF scanners are useful for preliminary readings, but they cannot penetrate internal layers of doré or account for non-uniform distribution of gold and silver. In practice, discrepancies of 3–10% between XRF and fire-assay are common, especially in bars produced without industrial homogenization. This difference explains why professional buyers in Hong Kong, Dubai and Turkey insist on melting and sampling witnessed by the seller.

International doré transactions follow different regional standards. In African markets, purity is often estimated rather than verified, and settlement structures depend on local refinery capacity. Turkish refineries offer competitive processing but typically require multi-day holds for laboratory queues. Hong Kong provides one of the most efficient operational models globally, combining supervised melting at accredited refineries, independent fire-assay verification, and next-day settlement under a 0% tax environment. This makes it an attractive hub for sellers seeking predictable turnaround times and internationally recognised reporting.

A well-prepared doré bar should be solid, fully melted, free of cavities, and without excessive slag on the surface. Sellers who mix old jewelry scrap, grain, and partially melted residues into a single batch often see unpredictable assay outcomes and reduced net gold content. To achieve reliable results, suppliers are advised to maintain consistent melting practices, document the batch, and avoid mixing material of different origins.

For parties transporting doré internationally, maintaining an unbroken chain of custody is essential. Proper sealing, batch labelling, photographic evidence, and declared weights help reduce the likelihood of disputes. Once the material arrives in Hong Kong, final valuation depends entirely on the official fire-assay certificate. Settlement is executed based on verified purity, with terms discussed individually depending on batch size, logistics, and recovery characteristics.

These operational and technical nuances make doré trading different from standard bullion transactions. Sellers who understand the factors influencing purity, recovery and assay consistency achieve more predictable outcomes and benefit from faster, cleaner settlement in established hubs such as Hong Kong.

FAQ — Doré Purchase & Settlement

The latest Golden Ark Reserve news

Buying Physical Gold: Market Integrity, Settlement, and Risk Control

Buying physical gold is a transaction process in which price agreement, delivery, ownership recognition, and settlement finality resolve…

How to Buy Physical Gold Offline in Hong Kong: Dealers, Process, and Transaction Security

Offline physical gold purchase in Hong Kong is a dealer-executed transaction where gold ownership transfers at the point…

Gold Spot Price vs Premiums: Structural Pricing Mechanics of Physical Gold

Gold spot price functions as a wholesale benchmark derived from financial gold markets. Physical gold trades through a…

CIF vs FOB for Gold Doré: Incoterms Allocation of Cost, Risk, and Delivery Obligations

Gold doré transactions use Incoterms to formalize delivery obligations, risk transfer, and cost allocation between seller and buyer.…

Gold vs Crypto vs Bank Transfers: How Capital Moves, Settles, and Stays Under Control

Capital can be transferred through three fundamentally different systems: bank rails, blockchain networks, and physical gold settlement. Each…

What Is the Gold Spot Price

Gold Spot Price is the globally recognized reference price for immediate gold transactions in the professional bullion market.…

Offline Gold Purchase: Benefits, Security Controls, and a Step-by-Step Process

Offline gold purchase is a transaction process in which a buyer acquires physical gold bullion through an in-person…

Why Invest in Physical Gold as a Long-Term Asset

Physical gold functions as a monetary asset with no issuer risk and no dependency on financial intermediaries. Investors…

How to Buy Gold with Bitcoin: Process, Settlement, and Custody

Buying gold with Bitcoin combines digital asset settlement with physical bullion ownership. This article explains how a Bitcoin-based…